As we all know that H4 visa holders are not eligible to have a Social Security Number (SSN), but for filing U.S. tax returns and claiming them dependent on H1 visa holders, they do require a unique identification number, which is called Individual Taxpayer Identification Number (ITIN).

On H4 visa, me and my daughter (18 months) had no SSN number and we needed ITIN to file our tax returns. There are different ways to apply for ITIN, I am outlining them with my experience on ITIN submission and tax filing.

Important note: You can’t apply for an ITIN number before you file your taxes. You can only apply for it at the time you file your taxes.

Also, you should not file your tax return without ITIN’s else you will not get claims or tax benefits that H4 holders are entitled for.

Individual Taxpayer Identification Number (ITIN) and H4 Visa Holders :

What is ITIN number ?

Basically, it is a nine-digit tax processing number issued by the Internal Revenue Service (IRS) to foreign nationals (both resident and non-resident aliens) who have federal tax reporting or filing requirements (to claim tax benefits) but are not eligible to obtain a SSN.

It is used for federal tax purposes only.

Please note that spouses and dependents are not eligible for an ITIN or to renew one unless they qualify for a tax benefit or file their own taxes.

Why do H4 Visa holder need ITIN number ?

ITIN number helps individuals comply with the U.S. tax laws, and provide them a means to efficiently process and account for tax returns, payments and refunds under the provisions of a U.S. tax treaty.

When do we need to apply for ITIN number ?

We need to apply for ITIN as soon as we are ready to file our federal income tax return for a tax year, as we need to attach the return to our ITIN application.

Expired ITINs or ITINs that are about to expire must be renewed in order to avoid delays in processing your tax return. Process to renew expired ITIN’s is explained further.

How to Apply for ITIN Number and File Taxes?

An application for ITIN must include all of the following set of documents. I have described details about each of the documents and how to get them (with alternatives).

1. Application form – Form W7

The form used for this ITIN application is Form W-7, which can be downloaded from the IRS website along with the instructions on how to fill out the form.

Since we need to submit a W-7 for each ITIN we apply for, I filled one W-7 for me and one for my child.

There are different options available to choose for reason of applying ITIN, for me it was “e, spouse of resident alien” and “d, dependent of resident alien” for my little one.

For tax purposes, spouse is not regarded as dependent.

Link to download W7 form and instructions: https://www.irs.gov/uac/about-form-w7

2. Federal income tax return

Your original, valid tax return(s) for which the ITIN is needed. We cannot e-file the tax return if we applying for ITIN.

Attach Form W-7 to the front of your valid Federal Income Tax Return (Form 1040, Form1040A, and Form 1040EZ) unless you qualify for an exception (see page 3 of Form W-7).

You may use TurboTax or other free e-software to fill your return, leave the SSN section blank (for whom you are applying ITIN), fill your return and print it out.

As you will be filing your tax return as an attachment to your ITIN application, you should NOT mail your return to the address listed in the Form 1040, 1040A or 1040EZ instructions.

Instead, send your Tax return, Form W-7 and proof of identity documents to the address listed in the Form W-7 instructions at : Internal Revenue Service, Austin Service Center, ITIN Operation, P.O. Box 149342, Austin, TX 78714-9342.

Always keep a copy of your file and you don’t need to give return envelope for sending back original documents. Applicants are permitted to include a prepaid Express Mail or courier envelope for faster return delivery of their documents.

The IRS will then return the documents in the envelope provided by the applicant.

3. Supporting documents for tax filing

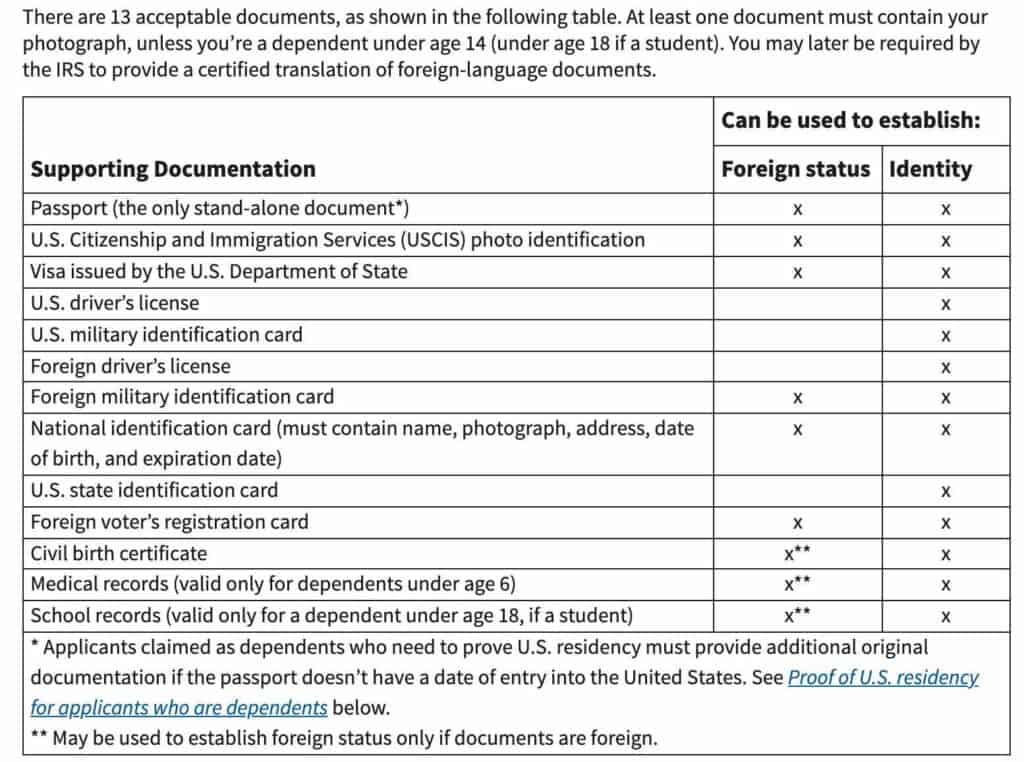

The original documents or certified copies of them to establish your identity and your connection to a foreign country (“foreign status”) and support the information provided on the Form W-7.

The documents should be acceptable as proof of identity and foreign status.

*A certified document is one that the original issuing agency provides and certifies as an exact copy of the original document and contains an official stamped seal from the agency.

An original and valid passport is the only document acceptable as proof of identity and foreign status.

If you do not wish to provide your passport (or certified copy of a valid passport) or it is unavailable, you must submit any 2 of the following 12 documents (including at least one identification with photo and one identification from your country):

All documents have to be latest except birth certificate as it doesn’t expire.

Proof of U.S. residency’ requirement for dependents

‘Proof of U.S. residency’ is required for dependents. Effective October 1, 2016, the IRS will no longer accept passports that do not have a date of entry into the U.S. as a stand-alone identification document unless the dependents are from Mexico, Canada, or dependents of U.S. military personnel stationed overseas.

Thus, now we are required to submit one of following document depending on dependent age:

- If under 6 years of age: A U.S. medical record that lists the applicant’s name and U.S. address.

- If under 18 years of age: A U.S. school record that lists the applicant’s name and U.S. address.

- If 18 years of age or older: U.S. school records, rental statement, utility bill, or bank statement that lists the applicant’s name and U.S. address.

Certification of Supporting Documents

According to revised rule in 2013, application for ITIN, must include original documentation or certified copies of these documents.

The certification can be done by the issuing agency or U.S. embassy or consulate. Notarized or Apostilled copies of documentation are no longer accepted.

How to get a certified copy of passport for ITIN?

- One can get his home country government agency (issuing authority of the document, which in the case of a passport is the embassy of the country that issued it) to endorse that the passport photocopy.

- The other good option for certification available to those not in U.S. (like back in homeland country) is going to the U.S. Embassy or one of the U.S. Consulate offices. This certification is equivalent to the certification by the IRS itself and is accepted by the IRS. But yes, the U.S. embassy is normally located in the country’s capital city only, and not all of the smaller cities have a U.S. Consulate office.

For these above options, check your local embassy office (if any) or U.S. Consulate office website for availability (as not all offices certify the documents), the prices and prior appointment.

Get the copies of documents (in case of passports all the pages, which bear entry and exit stamps, first page, last page, visa pages). They may want only color photocopies.

Take the appointment letter print out and carry all the originals and color photocopies at appointment time. Get your copies certified and send those to IRS by mail with return and W7 form.

To check U.S. embassy in your country for certification: http://www.usembassy.gov/

*In lieu of sending original documentation, applicants also have the option to use a CAA and designated TAC locations (explained further).

Where to Apply for ITIN and File Tax Return for H4 Visa Holder and Dependents?

1. Traditional Mail ( Normal Post)

First option is to mail Form W-7, tax return and supporting documents to IRS office. It’s always better to use certified mail to keep a track of your application.

But here is the catch, as per IRS requirements either the original documents or certified copies of these documents have to be submitted. Sending anyone of these is sometimes risky or not feasible.

Original passport

As in most of the cases, the passport is sufficient as it would serve both the purposes but many people are not comfortable for sending original passport as it is the most important document in alien country.

We had a recent bad experience when a UPS guy dropped my husband renewed passport to someone at next door; luckily, we were tracking the passport. We had our Indian travel planned for next month also so sending away passport was not at all an option for us.

Option – Certified Copies

Alternative for not sending the original passport was certified/endorsed copies of passport. But for this our problems were obvious, nearest Indian embassy was at least 8-hour drive.

2. Apply in person at Local TAC/IRS

An alternate of mailing original or certified copies of documents to IRS office is to apply for an ITIN by bringing completed W7 and tax return forms and documentation (original and 2 photo copies) to any IRS Taxpayer Assistance Center (TACs) in the United States or IRS office.

TACs provide in-person help in providing ITIN on appointment basis (update, from 2017 onwards) and are able to authenticate passports and National ID documents.

For dependents, TACs can verify passports, national identification cards, and birth certificates. These documents will be returned to you immediately.

For us, the nearest office IRS was at least 30 min drive, that too operating on weekdays with same working hours as my husband’s and on walk-in basis.

One of our friend had applied ITIN the previous year from there and it took him a whole day, so waiting there in long queue with a toddler after taking off from work was for sure not good option for us.

Update: From 2017 onwards, TAC will work on ‘appointment basis’ only so it could be a relief to many taxpayers and ITIN applicants.

Location of IRS center near you: https://apps.irs.gov/app/officeLocator/index.jsp

3. Through a certified acceptance agent (CAA)

Taking all factors (not willing to send original passport, busy working hours, unavailability of certified copies etc.) into account, applying through a CAA was best suited option for my family for filing our taxes and ITIN.

These CAA’s are authorized by the IRS and can help complete returns and file Form W-7. They can verify the original documents or certified copies for primary and secondary applicants, prepare a certificate of accuracy and forward application with copies of the documents they reviewed to the IRS for processing.

For dependents, CAA’s can verify passports and birth certificates only. The CAA will return the documentation immediately after reviewing its authenticity.

One of our friend referred us to a CAA who had her office within 5 miles from our place. You can check CAA in your area at link below. She helped us out in filing our taxes and had good knowledge too.

“We came to U.S. a year before in Feb so we filed our return as “Married Filing jointly” using 1040 A and submitted photocopies of our passport and original marriage certificate.

Since it was a requirement to submit original documents of dependents (my daughter in my case) that time in 2015 (if applying through CAA), and we didn’t want to submit her original passport, we submitted her original birth certificate and her medical record with her ITIN application.

Usually IRS sends the original certificates back, our friends got their child birth certificate back. We didn’t get ours back; as we had a backup, we never followed up.

Over all, it took us 40-45 mins in whole process with prior appointment and around $170 (with peace of mind protection) but yes we were totally satisfied and when she told about the juicy check which we were to get was the best part 😛 (though it depends how you have filled W2 form initially).”

Location of CAA in your area: https://www.irs.gov/individuals/acceptance-agent-program

Duration of Processing of ITN and Taxes ?

Within around 6 weeks after applying we got letter regarding our ITIN number and return. This is the average time limit for processing though it may take longer is you apply in peak time (end Jan-Mar) or from overseas.

If some doesn’t receive any letter from the IRS in or after 7 weeks, he can call the IRS to check the status of application at the IRS telephone assistance number: 1-800-829-1040.

ITIN Renewal: If renewing an existing ITIN, you may submit your Form W-7 renewal application (without filing a tax return) immediately. If you don’t renew your expired ITIN and you file a U.S. federal tax return with the expired ITIN, there may be a delay in processing your tax return.

How do I renew an expiring ITIN?

To renew an expiring/expired ITIN, submit a completed Form W-7(Application for IRS Individual Taxpayer Identification Number) along with your valid supporting original or certified copies (like for applying new ITIN) by the issuing agency to IRS.

Applicants must also select the appropriate reason for needing the ITIN, as outlined in the Form W-7/W-7(SP) instructions.

This can be submitted by mail to IRS center in Austin. Tax return is required for a renewal application.

In lieu of sending original documentation, you use an IRS authorized Certified Acceptance Agent (CAA) or make an appointment at a designated IRS Taxpayer Assistance Center (TAC) location like mentioned above for fresh ITIN applications

For more information: https://irs.gov/individuals/itin-expiration-faqs

More information about taxes and or ITIN visit:

General guidelines for aliens for tax purposes: https://www.irs.gov/pub/irs-pdf/p519.pdf

General information about ITIN: https://www.irs.gov/individuals/individual-taxpayer-identification-number-itin

Renewal of ITIN: https://irs.gov/individuals/itin-expiration-faqs

What was your experience filing Taxes? Any Additional pointers ?

Image Credit : pixabay.com/en/partner-hand-in-hand-family-group-1277168/

Hello,

Thank you for explaining the process in detail.

One clarification. Does W7 has to be sent with my spouse’s 1040 form? OR there has to be separate 1040 form sent for each H4 candidate?

Husband is on H1b and me/son are on H4, and opting for married filling jointly option.

Hi Ruchika,

Just curious what agent you used? It would help to go through someone reliable. Please let me know of their details.

Thanks,

Himanshu

my spouse is working and paying tax in india and i am working in US . can i file as married filing jointly . if yes , how to show his income over here.

Hi, I worked on h1b and my wife had h4 visa, me and my wife qualified as resident alien by amount of days in the U.S. . Currently we went back to our home country and don’t want to apply for her ITIN because it’s quite complicated to do it abroad.

1. Is it must for her to apply for ITIN?

2. If not how should I fill my tax returns? Filling jointly or filling separately?

Hi Andrew,

1. If you want to get tax benefits then yes you should. You can apply ITIN from abroad as well. Try using certified copies of documents. You can read more here: https://www.irs.gov/individuals/international-taxpayers/obtaining-an-itin-from-abroad

2. Filling jointly (you will need to declare her global income as well – if any).

I know it’s bit cumbersome, I would recommend you to consult any local experienced tax agent.

HI, I have one question to apply itin for my kids is there any time duration for a stay in the USA like the dependants must stay 6 months in USA to apply ITIN ?

Called IRS but CC agentcould not able to answer .

Hi,

No, there is no such requirement to ‘apply’ for ITIN. However, when you are claiming any tax benefits, you need to fulfill this requirement.

I am on L1 and my family are on L2 . We are applying for ITIN for my son (7 years old). We have prepared W7, what tax return we need? 1040/1040A/1040EZ? Can we apply for ITIN for my son when filing Tax for me and my wife (joint)? Thanks?

Hi,

I’m on H4 visa and my husband is on H1B visa, we came to USA last April, 2018 and need to do our tax return this time, I would like to clarify one thing, except W7 form, do I have to provide tax return form with my husband’s W-2 and 1099s from other financial institutions for 1040 form to apply my ITIN? Thank you.

Best Regards

Yushan

Hi,

I landed in the US in Jan 2018 and am on a H4 visa. My husband is on an H1-B. We can been informed by our accountant that I can apply for a new ITIN as soon as possible to receive the number before the date of filing the tax return. However, seeing the comments on this section, I understand that I need to file for a new ITIN at the time of filing the IT returns jointly with my husband in October. Am I correct?

Would request your advice please.

Thanks,

Trusha

Hi Ruchika ,

I have one doubt regarding dependents, I am in the USA for since year, But My family(Wife and 4 years Kid) is first time coming to the USA this month end. Can I file tax returns including family?By applying for ITIN number once they came to the USA.

Hi Ruchika,

Does both H1 holder and Spouse be present and produce documents(Retun forms and IDs) for ITIN at TAC ?

Thanks in advance. Will be booking the appointment based on your response.

Hi Ruchika,

Forgot to ask about the state tax returns. How to do that with just the ITIN application submitted at IRS ?

Thanks.

Most state will not process return without either a SSN or an ITIN. However some states accept state filings with W-7 attachments. Check with your state department of revenue. If they don’t, you can file an extension for your state until you receive your ITIN.

Yes, if both are required.

Hi,

Is ITIN required for filing state tax? I have just applied for ITIN and waiting for their response. Can we go ahead and file the state tax without receiving the ITIN? any suggestions? Thanks

Most state will not process return without an ITIN. However some states accept state filings with W-7 attachments. Check with your state department of revenue. If they don’t, you can file an extension for your state until you receive your ITIN.

Hi Ruchika,

Thank you for detailed write up. I have a query. My wife (on H4 visa) was in US for few months and returned back. She is not in US now.

Can I apply ITIN for her? If YES, what is the procedure?

Thanks a lot!

If you want to claim your wife in your returns, you can. Apply for her ITIN while submitting your return. as mentioned in above article Also, check another article relating ITIN ‘US Tax Filing on H1B for H4 Spouse, Dependent Children FAQs’.

No you can not apply without her. She personally needs to attend your local IRS

Thank you Rajesh!

You can apply by mail or through CAA located in India/US.

Mail: You need ITIN form, your tax return and your wife’s supporting documents. Best option for supporting document is to obtain a ‘true certified copy’ of your wife’s passport from issuing agency or US consulate in India. Then mail these documents to IRS office in Austin.

But before doing so make sure you determine your filing status (married filing separately or jointly). If you are filing as ‘married filing jointly’ you might need some other declaration forms too.

CAA: You can contact certified acceptance agents in India (https://www.irs.gov/individuals/international-taxpayers/acceptance-agents-india) as well

for tax and ITIN submission. There are few CAA’s that can help online too, I guess through skype interviews etc. Do a little research online and check their credibility.

The overall process will be little laborious but its nothing new or uncommon.

Thank you Ruchika!

Hey Ruchika,

Just wanted to thank you for taking the time and writing such a detailed post for many lost souls who are new to the US admin system like myself.

Your post has clarified a lot of things and given my husband and I, a way forward with our ITIN and tax return.

I have some travel plans so sending my original passport is not the best option so I’ll either go to a TAC or find a qualified CAA to handle our case.

Thanks again for this post. Really appreciate your effort.

Take care,

Sneha

Dear Sir,

I have one question regarding my Tax Status. I was in US from 2007 to 2014 on F1 Visa. Initially I was filing taxes as Non-resident alien while on F1 Visa and as soon as I completed my 5 years I started filing as Resident alien. I was only on EAD and never got H1B. I went back to India from Jan 2015 to Oct 2017. I am back in US on H1B Visa from Nov 2017.

°My question is do I file as Non-Resident alien (For First year) or once I have become Resident Alien in 2014 I have to continue filing as Resident Alien? I won’t meet Substantial Presence Test till Mid 2018.

I am going to ask a tax consultant about it but just wanted to know if you have any idea regarding it.

Thank you,

Ishan

Hello! Thank you for such a detailed sharing of your personal experience! I am currently on H4 visa and planning to get my ITIN. I understand that I need to provide a copy of duly filled Federal Income Tax Return. My question is, where can i get this specific form to fill out and submit? Thanks again!

Hi, form depends on your residential status. After determining your status (https://www.irs.gov/pub/irs-pdf/p519.pdf ), you can download form from here: https://www.irs.gov/individuals/international-taxpayers/relevant-irs-forms-and-publications-for-international-taxpayers.

Submit with ITIN form like mentioned above in article by postal mail or by using CAA or TAC services in your area.

Thanks so much for the information.

I’m on H1-B visa. My wife has H-4 Visa. She is neither working nor studying not earning any money.

Here are some questions raised while filling W7 form

1.What boxes shall she check in the first filed in W-7 form?

2.Does she pick “Dependent of resident”, “Spouse of resident” or “Dependent/Spouse of non-resident”?

3.Can we check multiple multiple boxes?

I’ve read “Instructions for Form W-7” but they’re not helpful at all.

Thanks in advance.

Hi,

I applied for an ITIN for my wife along with my federal tax refund on February 7 2017. I received a notice CP566 on March 17 2017 to share the original passport of my wife. I sent them my wife’s passport on March 22 2017. It was delivered on March 24 2017. I got a CP567 notice today saying that my wife’s ITIN application is rejected because they didn’t receive the document that they requested for and we didn’t receive the original passport back. Has anyone faced this situation before?

Hi,

I had applied for the ITIN for my wife and had got the Passport documents verified at the TAC. Now we got a CP566 asking for the passport again. We are planning to send the certified copy but the concern is that the Indian consulate does not certify the Visa page. They only certify the first and last pages.

What should be done about the visa page. My wife is already in the US.

Hi Suyash,

I am not sure whether certification of’ Visa page’ is ‘mandatory’ for ITIN while certifying passport photocopy in your case. W-7 Instructions do suggest photocopy of important passport pages but they have also mentioned that certify copy must include the U.S. visa pages if ‘a visa is required’ for your Form W-7 application like in case of dependents. Check back with IRS helpline for the same. I also read in few threads that Indian consulate certified Visa page but I guess I don’t have so concrete information. Its better to cross check.

hello,

I applied ITIN for my wife along with my tax return through my tax preparer. She is a CAA agent. After couple of weeks I got a letter (CP 566) from IRS asking for some supporting documents or to send her original passport. Can I make an appointment at the local IRS office and certify the documents or passport of my wife. Visa expiration date is sep 2016. But I got my I-797 renewed. After that I never went to India for a restamping.Is this the reason I got cp-566 letter from IRS . Can we go to local IRS office and verify the documents there so that I can get my wife’s passport back.

Please reply

Thanks,

Biswa

Hi Biswakesan,

It could be lack of any of supporting document too. You can inquire from IRS helpline for the reason behind. Also check back with your CAA, she should help else IRS office is an option.

Very helpful, thanks!!

Hi,

Thanks for this note!

Am hoping to get clarification on one item.

I shall print the tax return indicating my married status, attach my spouse’s W7 and then mail it to the IRS. Correct?

Turbo Tax keeps asking for my Spouse’s ITIN or SSN before allowing me to print the tax return.

Chicken/Egg kind of situation.

Thanks again,

nimesh

Hi Nimesh,

Skip error check, save the forms as pdf on your system and then print. Also, under file tab you will see ‘file by mail’ option where you can download forms.

Hi Ruchika,

There is an entry for “Date of Entry into US” in the W-7 form. Is it the first date of entry or latest?

I came to US with my wife in Apr 2016 first time, then we travelled to India in Jan 2017 and came back in Feb 2017. All dates are stamped on passport.

Which one needs to be entered in W-7?

Thanks,

Bharat.

Hi Bharat,

The first date of entry.

Hi, For itin, I have a medical summary for my daughter who is 1 year old . It has all information except hospital phone number. Any idea how to request details from hospital on letterhead for itin to accompany the medical record and what information or format it has to be. Appreciate your help

Also forgot to mention she has a valid date of Entry stamp in her passport. Is us residency proof required if there is a valid date of entry. Thanks

Hi Vijay,

Proof of residency is not required if her passport has valid entry stamp.

You will require her medical summary only if you are not using her passport for proof of identity and foreign status.

You can normally request hospital to provide the updated information you need. There is no specific format but a medical record should include following,

-It must be dated no more than 12 months from the date of the Form W-7 application.

-It must contain the child’s name, date of birth, and verifiable address.

-Shot/immunization records (will be accepted only if they document the applicant’s name and chronological dates of the applicant’s medical history and care).

-Record must document the name, address, and phone number of the doctor, hospital, or clinic where treatment was last administered. If this information is not printed on the medical record, the medical record must be accompanied by a dated letter providing the required information on official letterhead from the federal authority, physician, hospital, or clinic that administered the latest care of the child.

Thanks for the Reply. Just to clarify one more item – Valid entry stamp is the customs and border protection seal which they put at the port of entry at the airport immigration with date admitted correct? There is also a visa class but valid until date is not filled but its there in i94. Let me know whether my understanding is correct. Thanks

The one on passport

Hi Ruchika,

had a question regarding starting Oct 1 2016,‘Proof of U.S. residency’ is required for dependents.

Is this required only if the date of entry into US is not stamped on the VISA or it a mandate anyways?

Please clarify. Thanks!

Hi Anoop,

Earlier passport was regarded as stand alone document but now (according to new rule) passport is no longer regarded as a stand-alone document for dependents if no date of entry into the United States is present. Thus applicants claimed as dependents ‘must’ prove U.S. residency (unless the applicant is from Mexico or Canada or the applicant is a dependent of U.S. military personnel stationed overseas).

If date of entry into US is not stamped on the VISA, additional documentation is required. Else nothing.

I found this article and the comments on this page very helpful in my application for H4 ITIN a couple of years back: https://sreenath.net/2014/04/03/tax-returns-itin-h4/

Hello,

I have a few questions.

1) My wife is here on H4 (no EAD), and zero income. Does she HAVE to file taxes? Is there any legal requirement for her to file taxes?

2) If the answer to the above is NO, then can i still file as Married Filing Separate?

From reading the earlier answers, it seems like H4 with zero income only has to file taxes if the H1 wants to take advantage of tax savings from Married Filing Jointly, is that correct?

Yes that’s correct.. you’ll get better returns.

Thanks so much for the info. I have a question regarding 1040 item 61: Health care: individual responsibility (see instructions) Full-year coverage. Were you present in the US for entire or part of the year. If somebody got married in the middle of the year and their wife came to the US after that, does she need to pay penalty for not having insurance in the part of the tax year prior to coming to the US? Or should they select full-year coverage?

Hi Rohan,

I am not very sure but she may qualify for exemption as legally she could not be present before that.

I came in July’15. You don’t need to pay penalty for the the time prior to coming to the US.

Hello

I have a quick question on the medical records for the dependent under 6 years of age. Is there a particular format of the medical format that I should ask for from the pediatrician’s office?

Would really appreciate a response on this 🙂

Hi Baldeep,

There is no specific format but a medical record should include following,

-It must be dated no more than 12 months from the date of the Form W-7 application.

-It must contain the child’s name, date of birth, and verifiable address.

-Shot/immunization records (will be accepted only if they document the applicant’s name and chronological dates of the applicant’s medical history and care).

-Record must document the name, address, and phone number of the doctor, hospital, or clinic where treatment was last administered. If this information is not printed on the medical record, the medical record must be accompanied by a dated letter providing the required information on official letterhead from the federal authority, physician, hospital, or clinic that administered the latest care of the child.

An SSN is needed when applying for a State Tax return, in my case New york. Do you file the state tax refund application along with the federal tax refund and W7 application?

Moreover, my wife and me travels a lot, therefore she cannot afford sending her passport for 6 weeks. If we apply to a local IRS office, are they keeping the passport ?

Hi James,

If you are applying at IRS office, they will return her passport back at same time.

Regarding state taxes, I am not very sure as I live in tax free state. Few states accept state returns if you write “ITIN Applied” under the SSN fields and attached a copy of the filled Form W-7 as proof. Else, you have to wait to file your state tax till you get your ITIN. Your tax assistance agent at IRS office can help you with that at the time of applying ITIN with federal return.

Apply for ITIN. They’ll return ur passport same day. Once you get the ITIN no. Then apply for tax returns.

Do they also need a visa? for ITIN

what If you do not have visa; as you have a new passport which was created in USA

Hi Ravi,

I am not sure what you are trying to ask, esp “If you do not have visa”! ? Is it a new passport like in case of US born child? If so then you have SSN for child and ITIN is not required. If something else please elaborate.

Hi Ruchika,

Thank you for replying back

New passport was issued after the previous passport was lost. The previous passport had a visa; but new issue passport does not have visa.

What would be best way to file ITIN

Hi Ravi,

You can submit any of two documents (if not using passport) listed in table on page 2 of https://www.irs.gov/pub/irs-pdf/iw7.pdf depending on age of your dependent.

Also, according to recent law for dependents (for proof of residency), a passport that doesn’t have a date of entry will no longer be accepted as a stand-alone identification document for dependents. So one has to furnish one of additional document with passport also depending on age of dependent.

– If under 6 years of age: A U.S. medical record that lists the applicant’s name and U.S. address.

– If under 18 years of age: A U.S. school record that lists the applicant’s name and U.S. address.

– If 18 years of age or older: U.S. school records, rental statement, utility bill, or bank statement that lists the applicant’s name and U.S. address.

I am not sure if they will accept passport without any kind of visa stamp at all. Its better to submit other two documents as mentioned in publication esp. if you are mailing your documents to IRS.

Hi,

I filled my tax returns and W7 (to apply ITIN for my wife and daughter) and went to local IRS office in Washington DC after taking an appointment. The guy carefully looked the forms and identification documents. He accepted and stamped them and provided reciepts to us. Happily we went back home.

After couple of weeks we recieved notification from IRS that W7 detail is missing. It was strange because we were sure everything was done properly and IRS local office carefully looked all the details before accepting it. Anyhow, I again mailed the W7 details to them. After another six weeks IRS sent a check of a very low amount stating the reason that I did not supply ITIN information of my spouse and daughter and they are fining me $25 bucks for misinformation. In other words they were saying that i dont have wife and daughter and i tried to fraud them. WTF??

I have now appointment with CPA to resolve the issue. But I would suggest to take ITIN for your H4 dependents as soon as you land on US soil. Don’t wait for tax return season for that. Seems like they are different departments within IRS and have serious lack of communication between them.

Find your local IRS office, take appointment and show them identification documents and submit W7 there to take ITIN. Do that before March or after August when IRS local offices are usually empty with no queues to wait for hours (special note for parents with small children).

And by the way if you are employed and getting salary then usually they owe you to give your money back. Therefore you are not bound to follow “tax return deadlines” if taxes were deducted regulary from your salary. Don’t hassle for ITIN in fear of deadlines (unless you actually owe some money to them).

Sadly you can’t apply for ITIN without attaching the federal tax return. So no, you can’t apply just for the ITIN as soon as you land on U.S. soil

Yes, federal tax return is required to to file ITIN so you cannot file for the same as soon as you land US. Also, if you don’t owe any money and are expecting a return, there is no deadline to file a return or apply for a ITIN in peak periods. But failure to timely file the tax return with a complete Form W-7 may result in the denial of refundable credits, such as the Child Tax Credit etc.

Hi Ruchika – I have to apply new ITINs for my family and it seems that the ITIN numbers should have been “ISSUED” (not only applied for) by Apr 17, 2018. I also understand that ITIN application can only be done with Income Tax Return. Since I don’t any amount to IRS, does it mean that:

1. I file for an extension so that the due date becomes Oct 15, 2018

2. I go to IRS anytime after Apr 17 and file return + apply for ITIN

Questions:

1. Does this mean that I will be able to get Child Tax Credit then?

2. After filing extension, can I still go to IRS on Apr 12 (I have an appointment), file return and apply for ITINs and they will still consider due date as Oct 15 instead of Apr 17.

Kindly clarify.

Hi

Does this apply for h4 EAD also. I have an EAD but with a h4 visa. Recently in an interview they asked me what form should I fill up. A-W8 or A-W9. What should I answer?

Hello – Can you please post an article on the experience for filing taxes in India for people on H1 in USA.

Thanks in Advance.

Hi Ruchika,

Thanks for detailed article. But i have basic query which i think you should had answered first.

1.Do dependents who are not working need to file tax returns and if yes why?

2.What if they don’t file return? what are pros and cons.

3.Does an h1b visa holder get any tax benefit if his spouse and children are living in USA totally dependent on him.

4.What are crucial dates of filing tax returns in USA?

Please take time to answer these questions it will make your article a lot holistic.

CoolGuy,

1. If one person is on H-1 and then the other is on H-4, then the taxes should be filed as “married filing jointly” in order to avail maximum benefit. Your slab rates almost double for the same tax rate when filing as married filing separately. As one spouse has no income, its a good saving. However, for this to happen, H-4 visa holder needs to have an ITIN (or SSN, if previously issued).

2. In order to avail best tax return, it should be filed as married filing jointly for which ITIN would be needed. If H-4 holder is not included in tax return, then you would end up paying higher taxes.

3. See (1)

4. April 15 is the deadline to file tax return for previous year. By Jan 31, you should receive W-2 from your employer. 1099s from other financial institutions is usually received by 1st or 2nd week of March.

Cool guy,

Few more addition:

3. Child benefit can only be availed if child is living in USA with H1 holder. For spouse, you can claim benefits even if she is not living in USA or even never had visited USA. For “married filing jointly” , both have to be show global income, if wife was working. Else one can also opt for married filing separately and claim personal exemption and spouse exemption but those may not be as good as married filing jointly.

You can refer to link provided in above article for more basic understanding regarding tax: Tax guidelines for aliens https://www.irs.gov/pub/irs-pdf/p519.pdf

Hi

I have mailed the certified passport copy on April 7 but when I spoke to irs office customer service guy then he told me that they didnt recieve my certified copy mail and hence rejected the ITIN request.

What should I do?

Hi,

Did you check your refund status online? Also, IRS sends a notice CP566 for additional or missing information and CP567 for rejection. If you have got any of these, reply to IRS accordingly while sending needed documents again.